Article - July 15, 2019

Post-Acute Care: Five Key Traits of Growth-Ready Providers

Key Takeaways

Demand for post-acute care is growing as the U.S. population ages.

The Medicare market is becoming increasingly managed, with growing Medicare Advantage share.

Payors are more closely scrutinizing the efficacy and economics of post-acute care.

Providers that shift their strategies and capabilities toward a value-based model will be best positioned to win in the emerging landscape—and, as such, represent attractive opportunities for strategic buyers and investors.

For more insights on the post-acute care landscape from the Harris Williams Healthcare & Life Sciences Group, please click here to download the full report.

Rarely does a patient return to full health the moment their stay in an acute care facility ends. More typically, complete recovery requires a period of post-acute care, a large and critical part of the broader healthcare continuum.

Consisting of five subsegments—long-term acute care hospitals (LTACHs), in-patient rehabilitation facilities (IRFs), skilled nursing facilities (SNFs), home-based care and unskilled home care—post-acute care provides vital services patients need following hospital stays or to manage chronic conditions (Figure 1). And with demand for post-acute care only expected to grow in the coming decades as the U.S. population ages, the segment offers opportunities for investors and strategic buyers interested in moving into or expanding their presence in the healthcare space.

Figure 1: Five Post-Acute Care Settings

A Demographic Tsunami

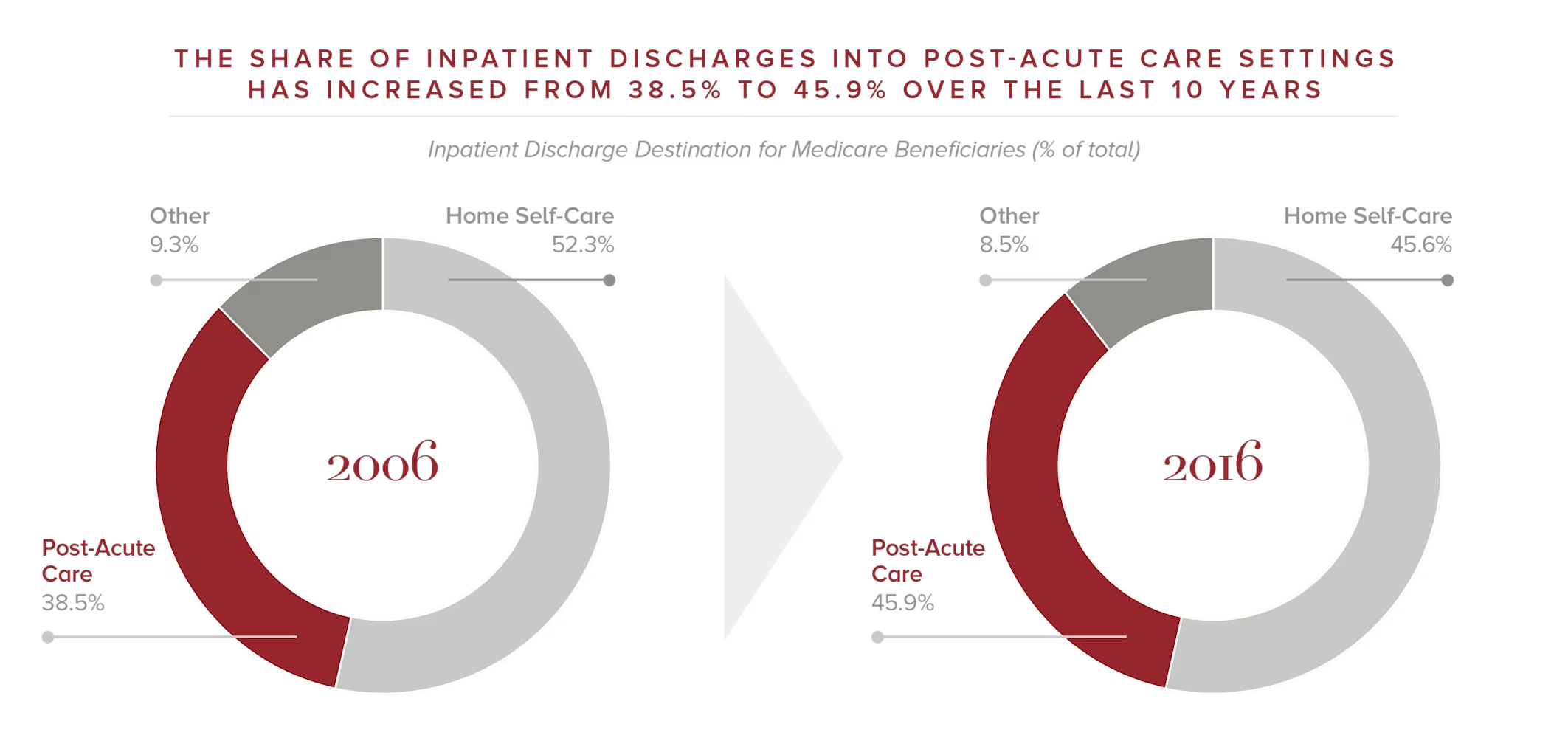

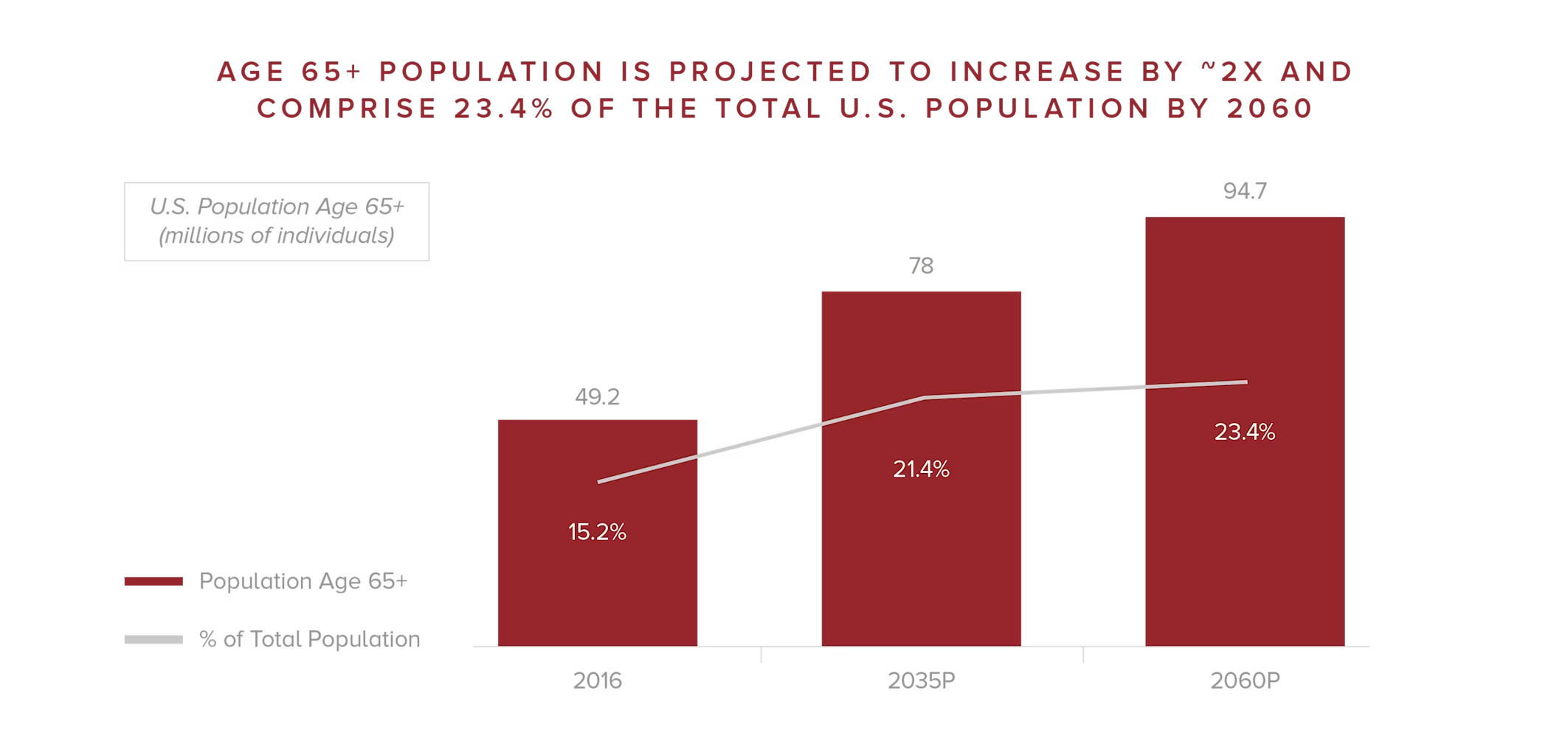

Between 2006 and 2016, the share of in-patient discharges into post-acute settings rose from 38.5% to 45.9% (Figure 2).1 That trend will continue in the coming years as the U.S. population gets older and requires more medical attention. By 2023, the number of adults over 65 will exceed the number of children in the country for the first time, and by 2060, older adults will account for nearly one-quarter of the U.S. population.2

Figure 2: Increasing Discharges into Post-Acute Care

“There is a demographic tsunami happening,” says James Clark, a managing director in the Harris Williams Health Care & Life Sciences (HCLS) Group. “We`re heading for a quarter of our country being Medicare eligible. That is a population that requires more care as a function of their age, and they typically need more costly care. The problem is enormous. Today, we`re discharging almost half of the people leaving a hospital into a post-acute setting of some type—that`s a lot of people who don`t just go home without needing any further care.”

Figure 3: A Demographic Tsunami

Indeed, the cost of care, like the number of people needing it, also continues to skyrocket. Because the vast majority of post-acute care is paid for by Medicare or Medicaid, the federal government has seen its spending in this segment balloon from $55 billion in 2006 to nearly $80 billion in 2016.3

Yet increased spending doesn`t necessarily mean better care. In fact, the traditional fee-for-service reimbursement model has given rise to misaligned incentives that can actually undermine the ability of post-acute care settings to effectively manage the population`s health.

“Today, the Centers for Medicare and Medicaid Services (CMS) generally pays for the quantity of care that you get—the number of days you stay in a hospital or the duration of care you get at home,” says Clark. “And there can be significant differences of reimbursement across the various settings, regardless of the amount of care that`s actually furnished. This can lead to patient placement decisions that reflect nonclinical factors, rather than a focus on where the patient can get the best care.”

From Fee-for-Service to Value-Based

Recognizing the growing challenge, the federal government passed the Improving Medicare Post-Acute Care Transformation (IMPACT) Act of 2014 to not only get a better handle on what Medicare is spending on post-acute healthcare, but also to improve the care people receive by switching from a fee-for-service model to a site-neutral and value-based care model. Under value-based care, specific care outcomes are measured, payments are closely aligned with those outcomes and the cost of care, and reimbursements are based on a patient`s condition and not the care setting or the amount of care provided (Figure 4). IMPACT mandates the creation of a standardized post-acute care assessment tool to measure outcomes and the cost-effectiveness associated with different settings.

Figure 4: Key Components of Value-Based Care

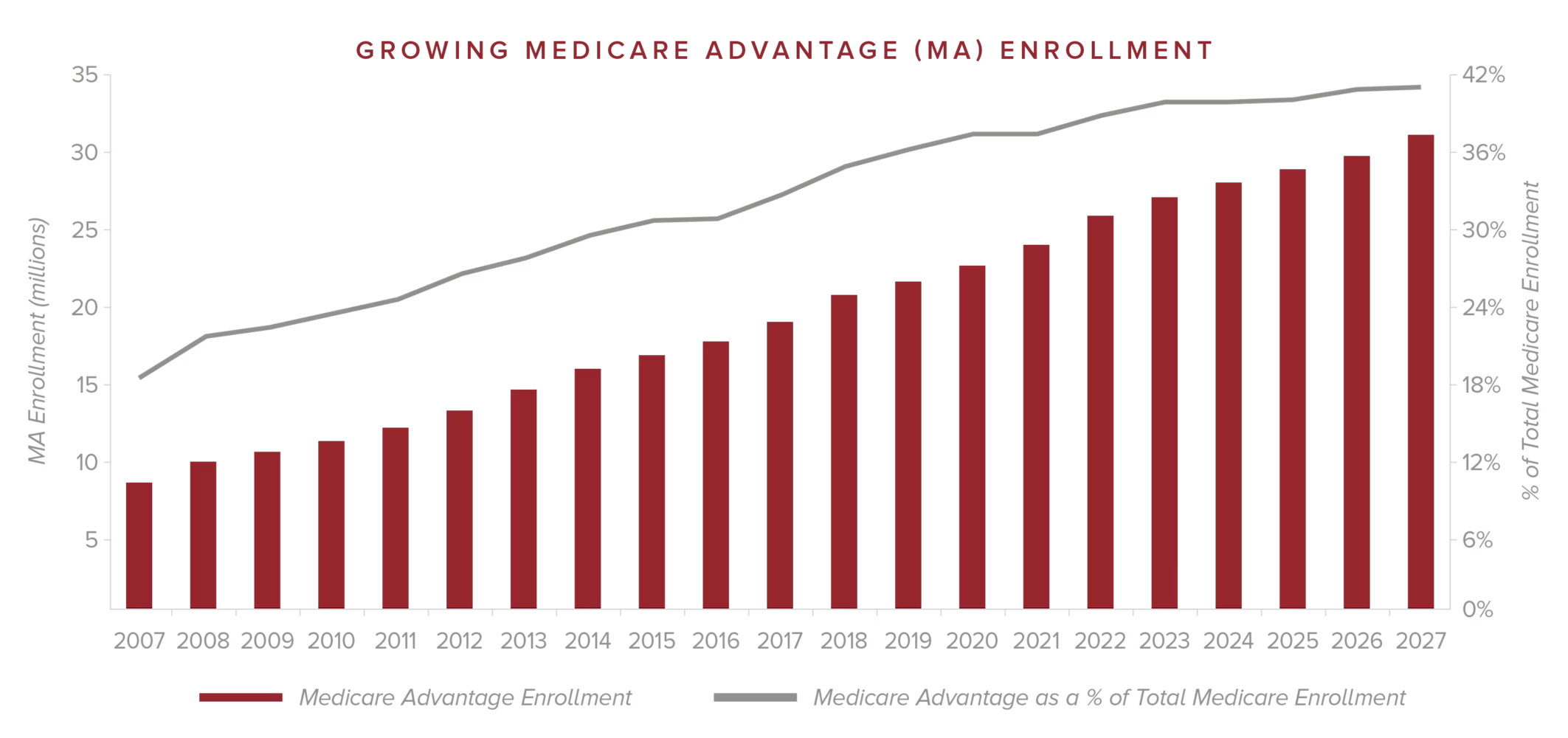

At the same time, the Medicare population is increasingly electing to receive benefits under a managed care model (Medicare Advantage). Medicare Advantage enrollment has increased by a factor of 2.5 since 2007 and is expected to represent more than 30 million covered lives and more than 40% of total Medicare enrollment by 2027 (Figure 5).4

Figure 5: Growing Medicare Advantage Enrollment

“With post-acute care moving toward an environment where care is more actively managed, it won`t matter where you get care—it will be site neutral,” Clark says. “The payment model will be much more driven by standardizing the assessments and the outcomes that they`re measuring, and paying for those, regardless of the setting of care.”

What this means for providers is that to get reimbursed, they need to take responsibility for the efficacy of their care while keeping total patient care costs as low as possible. This, in turn, requires providers to operate differently, developing new capabilities to thrive as healthcare shifts away from the fee-for-service model.

Five Characteristics of Growing Post-Acute Care Providers

Therein lie significant opportunities for investors and strategic buyers interested in the post-acute care space, says Clark. A number of savvy providers are actively developing and deploying value-based strategies that are positioning them for growth in the evolving healthcare market. As such, these providers can be attractive acquisition targets.

The most growth-ready post-acute care providers share five key traits.

Clark notes that a recent Harris Williams client exemplifies these traits: AccentCare. “I would describe the company as a very progressive, forward-looking post-acute care provider,” he says. “AccentCare addresses many of the challenges we`re seeing in healthcare more broadly and embodies the attributes investors are seeking.”

AccentCare is a nationwide leader in post-acute healthcare, with innovative partnerships and care models covering the full continuum—from personal, non-medical care to skilled nursing, rehabilitation, hospice and care management. Its approach to care, including proprietary disease-specific programs, consistently exceeds the industry average in avoidance of unplanned re-hospitalizations, faster starts of care and quality performance. Among its distinctions, AccentCare has a 4.5-star quality rating, and many of its agencies have earned the HomeCare Elite distinction.

Conclusion

In summary, says Clark, attractive acquisition candidates are those that are forward-looking and recognize where post-acute care is heading. “That means they`re already experimenting with different value-based payment models today and executing on some of them,” he explains. “Beyond dabbling, they`re taking the things that are working and implementing them in their business. And, above all else, they understand that clinical quality is absolutely paramount to driving the best outcomes—but that it`s also important to do that at the lowest cost. Providers that can achieve that difficult balance are those that are best set up to win.”

For more insights on the post-acute care landscape from the Harris Williams Healthcare & Life Sciences Group, please click here to download the full report.

1. MEDPAC

2. U.S. Census Bureau

3. MedPAC

4. MedPAC, Avalere Health

Published July 2019

Select Activity

Contacts

James Clark

Managing Director